As I have already mentioned in other posts, we bought the house in Ourense on April 11. Sergio, the former owner, had to arrange for the cancellation of the mortgage with Banco Santander, as he did not want us to withhold money to do it ourselves.

During the signing, we made the transfer with the description “mortgage cancellation,” hoping that the bank would act as soon as it received the money.

Months of waiting and uncertainty

Days passed, then weeks, and then months began to pass. Sergio always replied that he had not heard from the bank.

We had done our part, the money was there, and yet the bank was not making a move.

The legal limit not met

The beginning of July arrived. Upon investigating, I discovered that Spanish law regulates this process quite clearly:

- After paying off the mortgage, the bank must issue a zero-debt certificate free of charge. (Art. 82 LH + Bank of Spain: “this certificate must be issued at no cost”).

- With this certificate, you go to a notary, pay the IAJD (Stamp Duty) and submit the cancellation deed to the Land Registry.

- The Registry has a maximum of 15 working days to register the cancellation, provided that the documentation is complete.

In other words, by the beginning of July, the procedure should have been completed. Banco Santander was in breach of its legal obligations by not executing the cancellation.

The serious damage to the new owners

All this passivity is not just bureaucracy: it is seriously damaging to us. As long as the mortgage remains registered:

- We cannot apply for a new mortgage.

- We cannot apply for other loans secured against the property.

- The house appears as if it still has an outstanding debt, so we cannot sell it either.

In other words, we are stuck in limbo, which affects our finances, our legal security, and our emotional well-being.

Sergio’s passivity and our complaints

Sergio, the former owner, did nothing for months. His inaction left us completely exposed. So, in July, we decided to act ourselves:

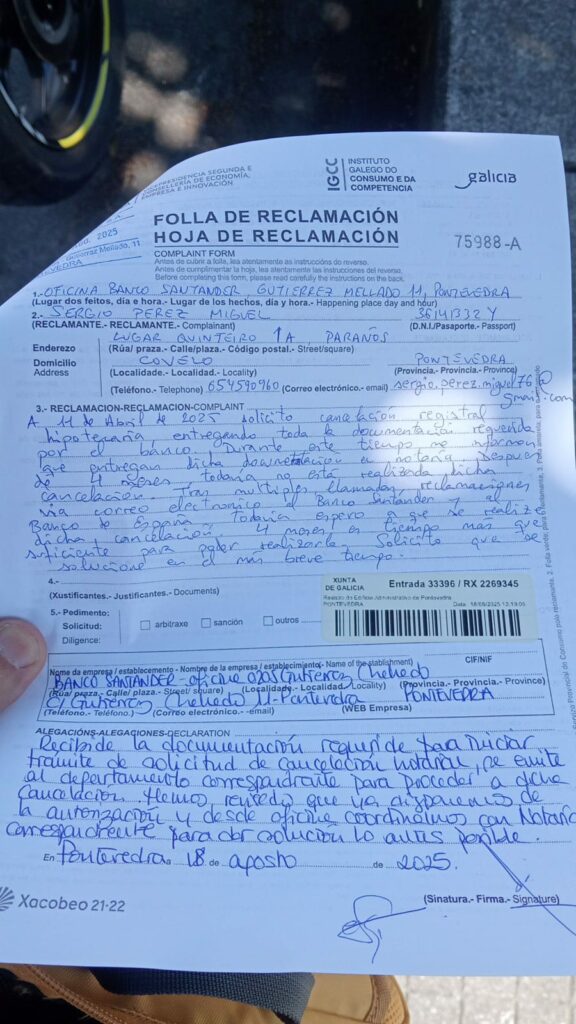

- We filed a complaint with Consumer Affairs.

- We sent an email to Banco Santander with a deadline of one month to respond.

- When we did not receive a response, we escalated the complaint to the Bank of Spain.

- We programmed a daily email, repeating the complaint.

The pressure mounts

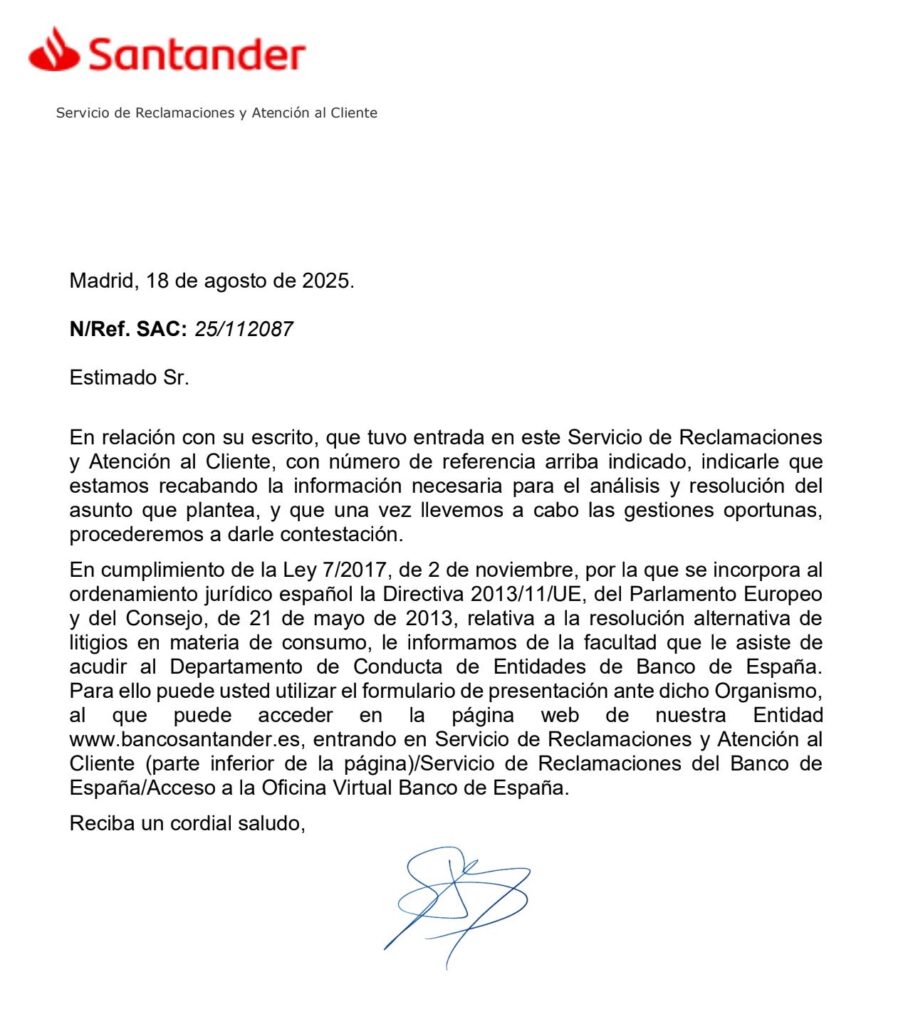

On Monday, August 18, Sergio went to a bank office and the Consumer Affairs Office to file a formal complaint. That same day, we received a response from Banco Santander saying that they were beginning to gather the necessary information to be able to give us an answer.

In other words, they did not even commit to cancelling the mortgage; they only promised to “gather information” in order to respond. This was yet another example of the incompetence and mediocrity of this institution.

On August 22, Sergio wrote to us to say that the bank had informed him that they had already taken the documentation to the notary.

What should have been a quick and automatic process turned into a real legal, financial, and emotional nightmare.

So, if anyone goes through something similar, my advice is: don’t wait, complain from the outset, and don’t let the banks violate your rights with total impunity.

Legal appendix

Mortgage Law, Article 82.

“Mortgage registrations shall be canceled: 5. Due to expiration, when 20 years have elapsed since the date on which the obligation should have been fulfilled according to the Registry and one more year has elapsed without any evidence of novation, interruption of prescription, or enforcement.”

Mortgage Law, Article 210. “Registrations may be cancelled by private application when, despite the expiration date not being recorded in the Registry, the following periods have elapsed:

a) Twenty years from the date of the last entry reflecting the existence of the secured obligation, or

b) Forty years from the last registration relating to the ownership of the property.”

Bank of Spain – Registration cancellation of mortgage: The bank must issue the zero-debt certificate free of charge, and with it, the cancellation is processed at the notary, the Tax Office (IAJD), and the Registry. The Registry has approximately 15 days to register the cancellation.

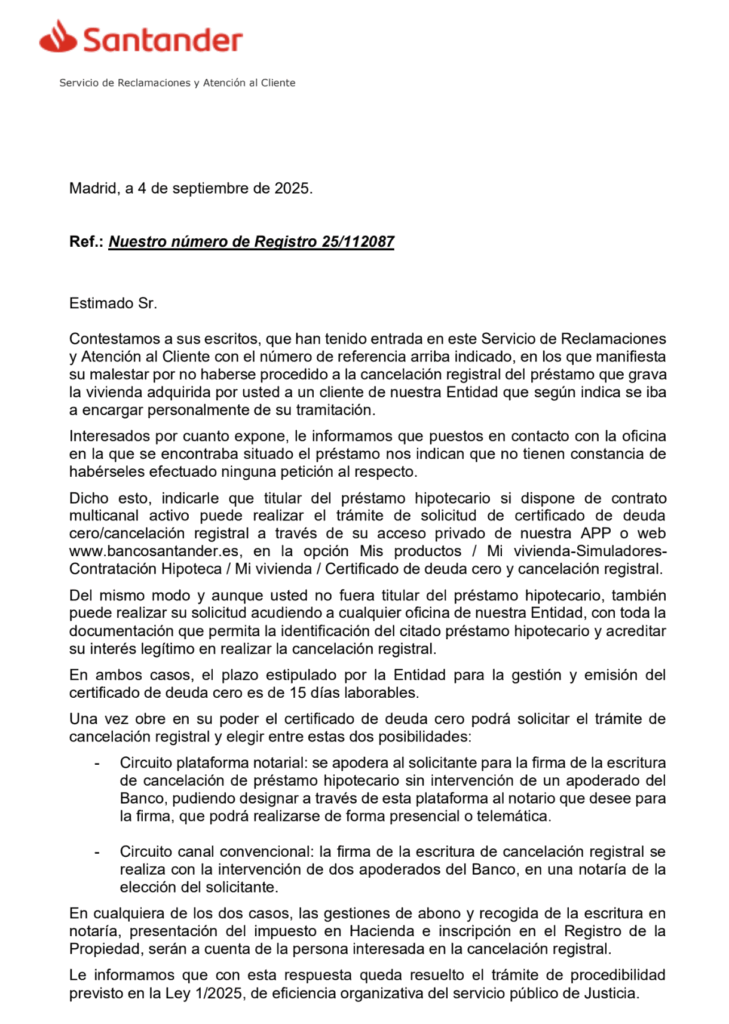

After months of silence, Santander finally responded to the complaint on September 5, 2025, with a textbook reply. Basically, they said that there was no record of any request at the office (which is a lie), that the mortgage holder could request the zero-debt certificate through the app or at a branch, and that with that document, the cancellation could be processed at a notary or registry (at the holder’s expense, of course). In other words, it took them half a year to give me a “do it yourself” response that solves nothing. Yet another example of how the bank neither understands the case nor has any idea what it is doing.

On September 10, Sergio informed us that he had already submitted the mortgage cancellation to the registry and that it would take between three and four weeks.

On December 9, Sergio finally confirmed that the mortgage had been canceled in the registry.

This case shows just how easily a procedure that should be automatic can turn into a real blockage of rights when a bank decides not to act. The cancellation of a mortgage is not a courtesy or a favor: it is a legal obligation whose delay has very serious consequences for third parties acting in good faith. If we have learned anything from this experience, it is that trusting, waiting, and “giving it time” only benefits the institution that is failing to comply. Claiming early, leaving a written record, and escalating the conflict is not an exaggeration: it is, very often, the only way to make the law actually be enforced.

More articles related to customer service and experiences with companies: